“What’s Next?”

I appreciate this chance to speak with you today in this beautiful new facility. Not long ago, as many of you remember, this spot was part of a run down community — which has obviously been brought back to life.

It’s changed.

And — in the midst of the good change around us, I feel it is appropriate to ask, “What’s Next” for our business and for us?

Where will we be in 20 years?

Will we be in 20 years?

I subscribe to Stanford’s “Growth Theory” economist Paul Romer’s view that growth occurs whenever people take resources and rearrange them in ways that are more valuable”.

To know what is “more valuable” is a matter of vision.

At the Twenty-second Communist Party Congress in 1961, Soviet Premier Nikita

Khrushchev’s vision was that within 20 years the Soviet Union would out-produce the United States in all the traditional sectors of industrial might — coal, steel, cement, fertilizer and so on.

In 1981, that vision was indeed fulfilled: that year the Soviet Union outdid America in every one of those industries.

They successfully reproduced a late 19th, century manufacturing based industrial economy…while the US was inventing a 21st Century chip, computer and information based economy.

A new world happened, shaped by a furious and unplanned burst of technological, cultural and economic force.

The Soviet vision of the future was as over-confident, but more importantly it was simply — over.

Nikita Khrushchev saw the future through the wrong end of a telescope where the moment seemed larger than it was — and the horizon smaller. He believed he could outwit history with a good plan built on dedicated incrementalism which had one gear — sideways.

As we meet today and at other conferences persistently speaking —to each other —my fear is that we might be inclined to use Nikita’s telescope to envision what’s next for us.

The satellite industry, including SES, has dictated broad global changes in other businesses from entertainment to defense; from detection and GPS to secure communication.

Today, the satellite business is producing reliable earnings for our shareholders. But undeniably, there are changes on the horizon dictated, if nothing else, by the changing worlds of our customers…. And they expect us to “get it”. They expect us to anticipate needs.

What the future holds is an exciting mystery. But, we are better off addressing possibilities while we have a chance to invest in them; to own them —-rather than to ignore or possibly be displaced by them. That’s what we will talk about today.

What we know is that the future will be vastly different.

It is estimated that within the next 25 years, science and technology will advance by a factor of 4 – 7x beyond the advancements over the last 25 years.

While we may hear this in stride — it is absolutely stunning in its business and social implications.

It means that where we stand today on the technology and science scale versus where we will be in the next 25 years — is a moment equivalent to being in the year 1650.

Think about it …1650!

Of course the 25 years from 1650 – 1675 saw their own dramatic developments. The English started drinking tea. Cromwell dissolved Parliament, and the first bank note was issued in Sweden.

During this time the world population expanded to 500 million, which is about one-third the size of India today.

Isaac Newton began experiments with gravity and Cheddar Cheese was invented.

The great Plague of London commenced and the English settled in Charlestown, Virginia.

Ice cream was invented and La Grand Vetel, a famous French chef killed himself because Louis the 14th didn’t like the dinner La Grand had prepared.

You could say a lot happened in those 25 Years…But, the world had seen nothing yet.

1650 was 225 years before the phone was invented and…a century and a half before the ratification of the US Constitution.

It was 200 years before Edison was born. It was 200 years before the US population would reach 23 million and China’s population then — was almost the same number as China Mobile’s cellular customers today (about 350 million).

1650 was 307 years before Sputnik and 315 years before the first satellite.

We are all familiar with the advances made in the satellite industry through compression. Well, get ready for the advances in history made by an unprecedented compression of knowledge in the next 25 years.

We’re about to enter “The Great Compression”.

We are looking at the equivalent change of the last 315 years — about to be compressed into the next 25 years.

What does this mean?

It means — for example — that if you are in the transportation business — the worst four words you could imagine for your business — may actually be heard in the next 25 years…The four words? — “Beam me up Scotty”.

The odds that the massive changes coming in the “Great Compression” will leave the satellite industry untouched — are zero. Change will come to us whatever we choose to do or not to do.

What will we be doing when it comes?

While technology is a “business”, it is also a force not to be controlled even by the best of intentions.

The genie is out of the bottle and the question is whether the genie is working for us or are we working for the genie?

Let’s spend a little time today on some broad issues of concern to our industry and to our customers:

1. U.S. Government business…

2. The commercial and media business…

3. The ramifications of change in both worlds and lastly …

4. I want to discuss a looming talent deficit as we face the coming “Great Compression”.

The US government business is, as you all know, changing rapidly. Saddam Hussein invaded Kuwait in August, 1990 and the US and Coalition forces liberated it in January of 1991.

During the 5 ½ months between Hussein’s invasion and ours, the American military was caught without the satellite capacity to track and mount the offensive.

They scrambled to acquire the needed transponders and didn’t have time for emergency appropriations to acquire them, so the costs were guaranteed —- by Private Citizen Ted Turner.

It was no coincidence that Turner’s CNN had the best and for a time the only video from Desert Storm.

The US military will never be caught like that again. Six months after our troops landed, DISA was created to make sure it wouldn’t happen again.

In the intervening years between Desert Storm and 9/11, the US military changed.

When 9/11 came, the military was ready with a system in place to fund $78 million dollars worth of contracts to provide the satellite and communications services needed. The contracts were in large part for bundled solutions in addition to the broadband commodity.

We learned then that in the future we need to leverage what only satellites can provide — advanced mobile communications and high speed internet access — while on the move —-anywhere in the world — via aircraft, boat, humvee or on foot.

What the military needs is megabytes, not megahertz. The military expects a ground and mobile capacity consistently capable of facial recognition.

Increasingly, the US government wants net-centric bundled solutions as well as broadband and they are calling upon us to be creative about it.

There is a demand for specific megabyte capacity per war fighter and we also know that this demand will only grow over time.

Increasing our military business means persistently increasing capacity and solutions.

For example, there is an ever expanding need for video teleconference capability (VTC) — for commanders in the field, in Washington, and for soldiers on the ground.

The invasion of Iraq was witnessed live on multiple screens in the White House Situation Room. Decisions could be made in real time with real data. Before that it was almost like Abraham Lincoln waiting for a telegram telling him that Grant had taken Richmond.

Soldiers on the ground also have growing “human terrain” needs in addition to VTC — also things like IM and secure chat capability.

Remember, in five years … 50% of the military will be Gen X and Y. They grew up in a digital world. The military has to grow with them – and so do we.

Whenever we speak of high speed mobile communications we must, in the same breath, speak of advanced development of “in-orbit” flexibility and new antennae development.

Satellites must increasingly have capabilities for re-direction and re-programming in space.

We must advance efforts to change frequencies and footprints in orbit.

We look over our shoulders for our competitors and can’t see some of them because they’re in front of us. They may not even be in our business.

For example, let’s look for a moment at the world of Nano-technology, once viewed as science fiction, but today may represent the “key enabling technology” of the 21st century.

Nano- technology is the “purposeful creation, manipulation and use of matter, physical structures and engineered devices with previously unimaginable dimensions”.

Nano-technology is starting to impact chemistry, biology, applied physics and medicine. The inevitable applications to the space and satellite world are just beginning to be imagined.

But, one way to think of it, knowing that a nanometer is one billionth of a meter, is to see every person as a nano-unit in a world with six billion people. That is the level of services and connection we must contemplate.

What are some of the ramifications of these great changes for our customers and for our business?

One ramification could be friction with our current customers and we have to think about that.

Many of our major customers are in the commercial media world — where things are also changing at a furious pace.

You Tube, MP3, file sharing and a host of other technological and social changes are threatening old business models like “Beam me up Scotty” would threaten transportation.

Our media customers are losing control of their customers who are increasingly less dependent on mass packaged media which we reliably deliver.

User generated and niche media (nano media) are replacing mass media.

Remember the 1998 Jim Carrey movie, “The Truman Show” where an unsuspecting insurance salesman’s life was made into a 24/7 movie for the entertainment of the town’s people?

Everyone in his fabricated town, his mother included, made a fool of him everyday — in their controlled entertainment world.

It was all run out of a network studio from which Truman eventually escaped– heartbroken.

Now think of The Truman Show in reverse where the insurance salesman watches everyone and anyone all day and all night, as he chooses.

Imagine control gone from the entertainment business into the hands of Truman… and the walls of the entertainment and media world come tumbling down.

That’s where we’re headed — along with our customers. User generated content and demand is going to turn the media world upside down.

Control will shift and it will be a new challenge to make an honest buck for the old institutions.

What is the response of the media and entertainment business to this creative destruction threat?

A recent book called “Wikinomics” – gives one example of how the media world is responding in the field of music… and I quote:

“Rather than embracing MP3 and adopting new business models, the industry has adopted a defensive posture. Obsession with control, piracy, and proprietary standards on the part of large industry players has only served to further alienate and anger music listeners…If your invention can be replicated at no cost, why should anyone pay?…Today a new economic model of intellectual property is prevailing”.

What is our response?

In the commercial and media world, let’s look at two business prospects on extreme ends of the continuum.

On one end, is the real prospect for business in the under and un-developed world. Half the world does not participate in the global economy in any way shape or form.

The developed world is increasingly understanding the value of changing this through governmental, private and NGO enterprises. It is not strictly a charitable exercise but a way to grow demand and markets.

The economy cannot be called global until this succeeds on a much greater scale. Central to these prospects are enterprises within our expertise. The sooner undeveloped countries have access to the information and communication revolution which, in many ways we can steer, the sooner there will be unprecedented growth and demand not evident in mature economies.

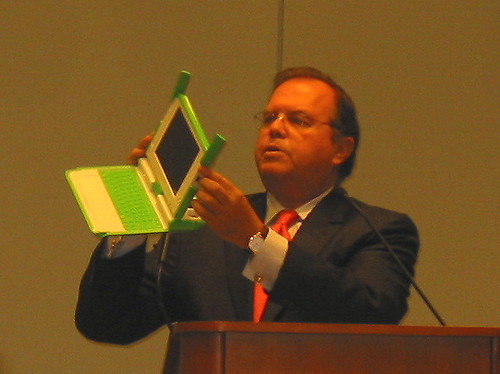

An example of how we extend the reach into being called “truly global” may be characterized by SES’ support of One Laptop Per Child (OLPC) Initiative.

OLPC is designed to put into the hands of children around the world the capacity of accessing information and connectivity with others ranging from people in their village or nearby villages, anywhere in their country and potentially around the world.

On the other end of the continuum are the possibilities in the media world with the disruption of old models.

But before we go any further, let’s make something clear. When we say “user generated content” we all think of You Tube or something like it. But You Tube makes no money and never has — except for its original creators who profited handsomely when they sold to Google.

When Google purchased You Tube and was asked how they intended to monetize it, the answer was: “we’ll figure that out later.”

Let’s be honest. You tube content is dominated by really, really bad material —and the most frequently viewed material inclines toward quality production and content.

But, as you have seen, Viacom is now demanding that You Tube remove all of its Viacom material. Others will surely follow. And You Tube’s offerings will begin to diminish.

Then there is Current TV, Vice President Gore’s effort, which is totally user-generated content. But it’s still part of the standard Dish and cable mass media package.

It’s user-generated content but it’s still part of the old business model for the system providers.

From our point of view, the revolution may have little to do with user generated content and everything to do with user “dictated” content.

I’m talking about free enterprise — for real.

Very recently, an outfit called Virtual Digital Cable in Illinois, has started a service to deliver cable programming without cable — by using only the internet. No trench digging or coaxial cable or fibre placement… no local franchise or fees. Naturally,

the legal challenges to VDC are blocks long but the point is Disruption for our customers and for us — is inevitable.

Product development and innovative bundled Solutions like IP Prime are important targets. But how do we most effectively and most profitably adapt to the new net-centric content world?

One answer is to consider what I called “My Geosynchronous Media” but someone told me that MGM was taken. Then I tried “My TV” but of course, MTV was taken. So for now let’s just call it “My TV Station”. “MTVS”

MTVS is a niche media for one; a nano niche.

It is the creation of a net-centric and net- neutral, trusted third party content aggregator designed as “My TV Station” which runs exactly what you want, when you want it on whatever device you choose.

The customer pays only for the exact content they want… whether it’s sports or Friends re-runs, all CSI or whatever. MTVS delivers it and pays the content provider — as a trusted 3rd party must.

Unlike cable and traditional satellite mass programming where you pay for things you never watch, MTVS gathers exactly and only what one person wants to watch when they want to watch it.

This direction means we would become a “Relationship Management” business in addition to our conventional business.

It also means we would, to an unavoidable extent, be in competition with our current customers.

Does that matter? Of course it does. But, these are the kinds of questions we need to face now before it’s too late to do anything about it.

My last issue is “People”. Are the Human resources and talent out there? Can we keep what we have and get what we need? What about the Demographic Wall?

Business Week Magazine recently advised new professionals to stay away from the space business because it offered “no future”. The engineering and science expertise that is the fundament of our industry is aging and this means on one hand that many are near retirement with a thin bench of possible replacement.

On the other hand, those who choose to stay in the business, and we need them desperately, are making it hard for new people we do attract to move up —- and also difficult to make change.

The truth is that as we move forward, this is not your “Father’s Satellite” world.

When it comes to attracting talent, you could say, we have an image problem natural to a maturing industry and …we have an advancement opportunity problem for the ambitious new engineer we do attract.

It is the science and invention that makes us grow. There is a clear shortage on the horizon. It is also true that as an industry, we have very poor public communication and we tell no exciting stories which we need to attract talent.

Just as the American military will be 50% composed of X and Y Gen soldiers who grew up in a digital world, my fondest hope for our industry is that we can say the same. If we can’t –then the future will be a lot harder to face.

I have shared some things to think about with you today and I appreciate your listening to them. I’m glad to hear your ideas as well — any time.

But for now, I see my time is up so I guess all I can say is Thank You and…“Beam Me Up — Frank ”.

Thank you very much.

ill be the country’s first citizen to stay long-term in space begining in the fall of 2008 a three month stint on the

ill be the country’s first citizen to stay long-term in space begining in the fall of 2008 a three month stint on the